tax incentives for electric cars uk

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. CO2 emissions of 50-75gkm and a zero emission range of at least 20 miles.

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Government grants as well as reductions in tax costs aim to make electric motoring more affordable.

. For example a brand new electric vehicle costing 20000 could save 3800 of corporation tax in the year of purchase whereas a petrol or diesel car of the same cost but emissions of 120gkm would only save 304 of corporation tax in its first year. From 18 March 2021 the government will provide grants of up to 2500 towards the cost of an eligible plug-in vehicle where it costs less than 35000. CO2 emissions zero emission range of at least 70 miles.

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. Company Car Tax Incentives to Go Electric. As we see the momentum build around consumer interest in electric vehicles EVs its interesting to see how employers.

From today 18 March 2021 the government will provide grants of up to 2500 for electric vehicles on cars priced under 35000. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Plug-in electric vehicles emitting less than.

If you purchased a Nissan Leaf and your tax bill was 5000 that. ETron EV eTron Sportback EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley. Bentayga Hybrid PHEV BMW.

There are many incentives for buying an electric car in the UK including plug-in grants for low emission vehicles zero or reduced road tax bills and accessible on-the-go electric charge points across UK road networks. There are further financial incentives associated with driving an electric vehicle. Lower emission vehicles up to 50gkm 130 mile range registered before 6 April 2020 will have a.

Road Tax VED savings. The UK governments Plug-In Car Grant PICG currently offers 2500 off the cost of an electric car but only for vehicles costing less than 35000. This funding is available for models costing up to 32000.

Drivers who find themselves requiring access to the London Congestion Charge Zone in an electric vehicle can save 1500 per day. More details Company car tax. Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances.

This means with electric cars you can deduct the full cost from your pre-tax profits. CO2 emissions zero emission range between 10 and 69 miles. The amount of the credit will vary depending on the capacity of the battery used to power the car.

Capital allowances on electric cars. Tax incentives for cars with lower CO2 emissions were introduced back in 2002 fuelling the subsequent dash for diesel and creating an early market for plug-in hybrids a decade later. Electric vehicles qualify for the Salary Sacrifice scheme the scheme allows employees to.

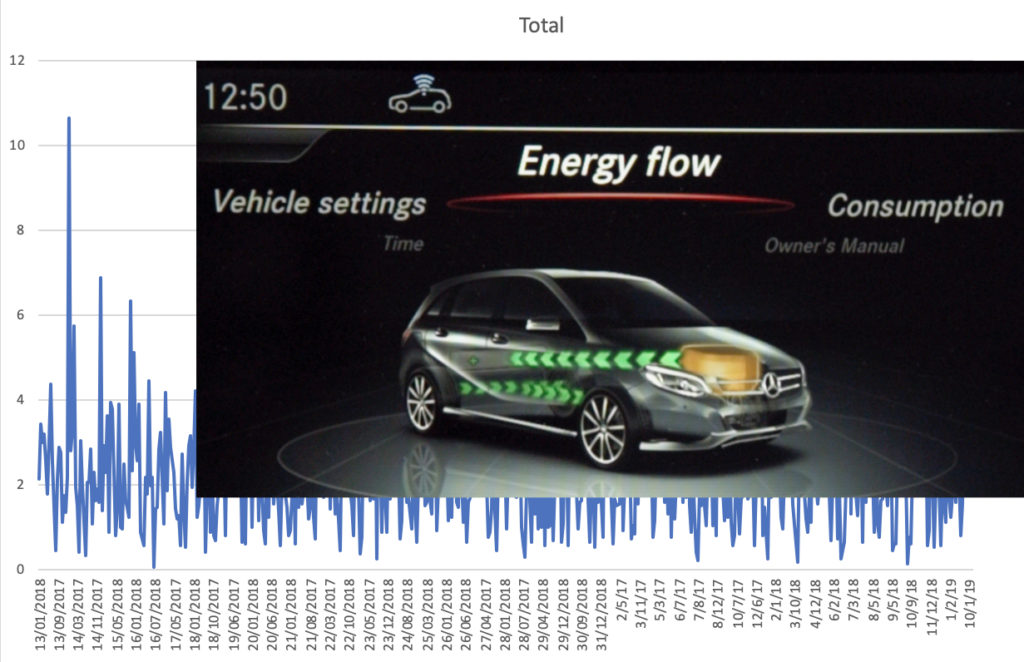

13 in 2018-19 and 16 in 2019-20. State and municipal tax breaks may also be available. Other electric car tax benefits.

The electric car tax for benefit-in-kind for pure-Evs has increased to 1 in April 2021 2022 and then 2 from April 2022 2023. Aside from the electric car tax benefits outlined above. Company car tax.

Correct as of the in the 2223 tax year. Pure electric vehicles costing less than 40000 are exempt from the Vehicle Excise Duty annual road tax. Fully-electric vehicles costing less than 40000 are exempt from the annual road tax.

If a vehicle is listed at over 40000 and registered after 31st March 2017 you are subject to an additional Premium rate tax for the first 5 years of ownership on top of standard VED whether your vehicle is electric or not. These vehicles have no CO2 emissions and can travel at. Tax incentives from the UK Government for using electric cars Tax on Benefits in Kind BiK.

Effective from 6th April 2020 fully electric cars will be zero BiK for 202021 1 for. Plug-in electric vehicles emitting less than 50gkm of CO2 have their company car tax set at only 9 for 2017-18. The BiK rate will rise to 2 percent in 202223 being held at 2 for 202324 202425.

Fully electric zero-emissions cars are exempt from VED Vehicle Excise Duty or road tax while hybrids both plug-in and non-plug-in benefit from a 10 discount on the regular annual VED rate of 150. The governments plug-in car grant is designed to promote the uptake of electric vehicles in the UK. Electric Cars Eligible for the Full 7500 Tax Credit.

This currently stands at around 320 per year. Privately owned electric cars. Therefore this will cease to apply for higher priced vehicles.

On a car costing around 40000 this could amount to a tax relief of 7600 in the first year. The grant will pay for 35 of the purchase price for these vehicles up to a maximum of 500. Where the employee uses his or her own electric car for business journeys the company can pay the normal tax-free mileage allowance to the individual of 45p per mile for the first 10000 miles driven in the year with additional business miles reimbursed at 25p per mile.

Additional Premium rate tax for all vehicles with a list price over 40000. Company Car Tax Benefit in Kind From 6th April 2021 both new and existing Tesla cars are eligible for a 1 percent BiK rate for the 202122 tax year. The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent.

Companies that buy EVs can write down 100 of the purchase value against their corporation tax liability if the EV emits no more than 50gkm CO2 paying just 1 CCT in 2021 and 2 in 2022. President Bidens EV tax credit builds on top of the existing federal EV incentive. Following a recent overhaul that system has made company car schemes among the most affordable ways to drive an electric vehicle.

Fully electric cars are currently exempt from paying VED. Plug-in hybrids pay a reduced rate for subsequent years. Every pure electric vehicle costing less than 40000 is exempt from the VEDannual road tax.

Businesses that buy EVs can write down 100 of the purchase price against their corporation tax liability if the vehicle emits no more than 50gkm CO2 paying just 1 CCT in 2021 and 2 in 2022. Plug-in hybrids less than 51km of CO2 are currently exempt from paying first year VED.

The Tax Benefits Of Electric Vehicles Saffery Champness

How Much Does It Cost To Run An Electric Car In The Uk Sust It

A Complete Guide To Ev Ev Charging Incentives In The Uk

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

What Are The Tax Benefits Of Having An Electric Vehicle

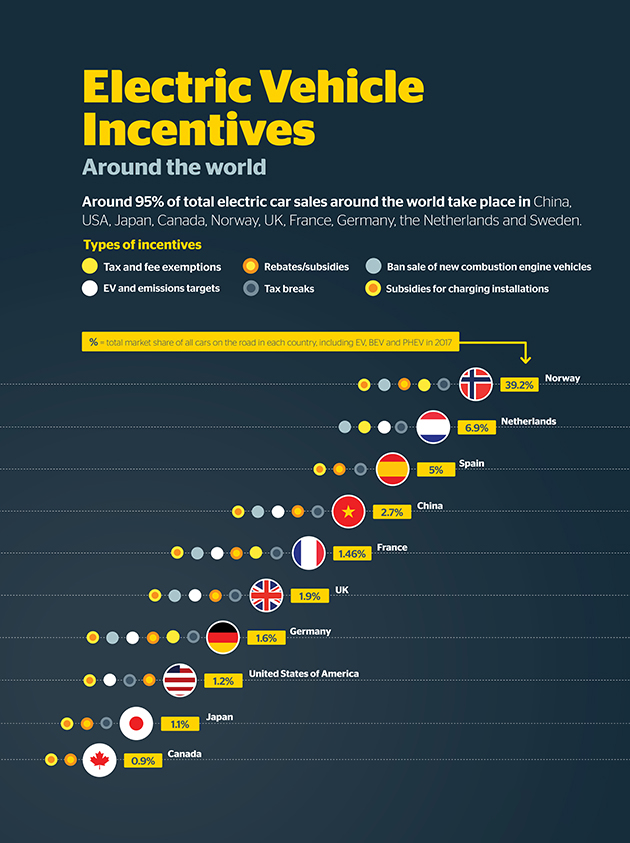

What Other Countries Are Doing To Encourage Electric Vehicle Sales Rac Wa

Government Electric Car Grants Save On Your Ev Leasing Options

The Tax Benefits Of Electric Vehicles Saffery Champness

Tax On Company Cars Does It Pay To Go Electric Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

Tax Incentives Grants For Electric Cars

Fiscal Incentives Spurring Electric Vehicles Sales But In Widely Divergent Ways International Council On Clean Transportation

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Vehicles Grants And Tax Benefits For Small Businesses Sage Advice United Kingdom

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Which Governments Are Promoting Electric Vehicles The Most

A Guide To Company Car Tax For Electric Cars Clm

Road Tax Company Tax Benefits On Electric Cars Edf